Welcome climate champions 👋🌿

In this blog we’ve got some financially-savvy climate tips just for you!

You likely already know that our collective choices have an impact the health of our planet. However, it’s also no secret that a significant amount of our impact is out of our control.

In conducting research for the NetPositiveLifeApp, we calculated that the impact out of our control makes up about a quarter of our carbon and nature footprint!

But alas, we’ve found that one fine way to actually make a dent in this so that we can work towards a net positive life is to move where we bank and invest💰➡️🌱

Shifting our finances to more environmentally conscious institutions will help mitigate the environmental harm caused by industries beyond our control. This is a relatively easy step to take on your journey towards being net positive for nature and climate.

What’s more, making these changes often comes at no additional cost and may even lead to better financial returns!

If this sounds like a smart idea read on to learn about the different financial actions you can take for the climate and the impact they will have on your carbon footprint.

Sound good? Let’s get to it!

1. Bank Ethically

Most high street banks have grown their business during a particularly extractive part of human development, meaning they are used to investing in oil, gas and mining. A large proportion of money sits with those banks in the form of deposits, investments or mortgages, making their investment decisions important. We can influence the banking sector by making a statement with who we choose to bank with. This will ultimately mean more investment in renewables, sustainable technology and nature.

To shift banks make sure to look at the bank’s record in investing in oil and gas, if they’ve made a declaration to stopping deforestation and whether they have an investment strategy in green technology. We can also write to our existing banks to request their record on these things in order to inform our decisions.

For a list of useful resources such as a guides to ethical banks and a League table on British Banks Carbon Emissions, check out the links and videos on this page of the NetPositiveLifeApp.

2. Divest Your Pension from Oil and Gas

Divesting your pension from oil and gas companies is a crucial step in aligning your investments with your environmental values. By redirecting our pensionS away from these industries, we can reduce our contribution to fossil fuel emissions and promote cleaner energy alternatives. While some may perceive this move as risky, it presents an opportunity to invest in more sustainable and ethical options that offer comparable or even better financial returns.

To learn more on how to divest pension from oil and gas, check out the resources on this page of the NetPositiveLifeApp.

3. Ensure your pension is investing in ESG or Impact Funds

Ensuring that your pension is invested in Environmental, Social, and Governance (ESG) or Impact Funds is essential for promoting positive social and environmental change. By actively choosing these investment options, you can support companies that prioritize sustainability, social responsibility, and ethical practices. Not only does this align with your values, but it also demonstrates a commitment to driving positive impact through your financial decisions. Plus, these investments often offer competitive financial returns, making them a win-win for both your conscience and your wallet.

To learn more on how to ensure your pension is investing in ESG or Impact Funds check out the resources on this page of the NetPositiveLifeApp.

Over 50% of all money in the world is held in pensions. The institution we choose to place our pension with significantly affects our journey to being net positive. Most of us are tied into our workplace pension scheme, which is either placed in a private pension or a company pension.

With private pensions, we can move the pension to an ethical alternative either using a financial advisor or by finding a scheme to administer ourselves—this can be done in a year.

With a company pension, we can influence where the investments are made by creating a lobby in our workplaces to ask for the pension to divest investments in oil and gas (similar to tobacco or slavery) and invest in ESG or impact funds. The outcome of such a lobby can be achieved in three to five years.

Either way, there is a route to moving our pension investments and ultimately choosing the power of our money through the institutions we associate with. By directing our money towards nature and climate initiatives we can indeed make a dent in our impact on nature and climate.

Wondering if there’s anything else you can do for nature and climate?

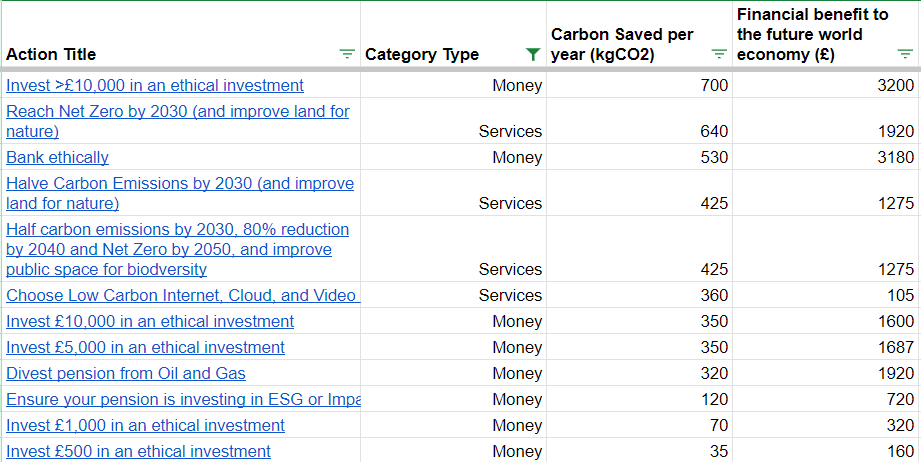

Here’s a list:

To learn more about the actions in this list check out the “money” and “services we use” pages on the NetPositiveLifeApp

In a nutshell…

To enhance your plan toward living a net positive life by 2030, assess where your hard earned money is going. By being mindful about where you we bank and invest you can have an impact in areas that are normally considered out of our control💰➡️🌱.